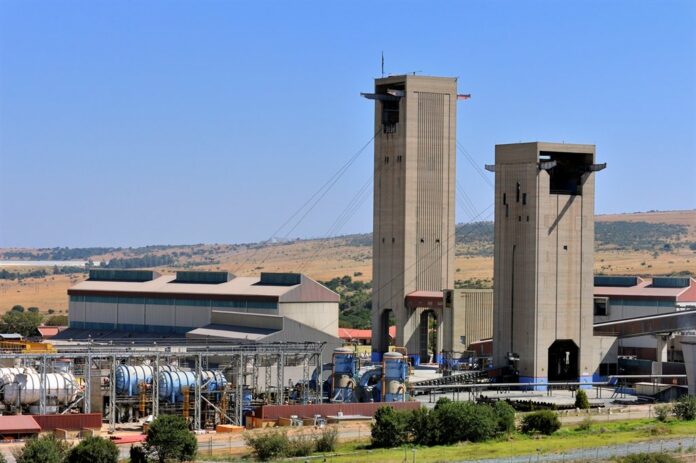

The Mponeng goldmine near Carletonville in Gauteng.

- Harmony will take ownership of the AngloGold’s world’s deepest mine, Mponeng, and other assets on October 1

- The deal is worth about $300 million.

- AngloGold Ashanti says exiting its South African operations will allow it to focus on high return projects elsewhere.

Harmony is set to take control of AngloGold Ashanti’s remaining South African assets – including the world’s deepest mine, Mponeng, following the approval of the $300 million transaction by authorities, the companies announced on Monday.

“This is a proud moment for Harmony, further demonstrating our well-established belief in and commitment to the sustainability of gold, our confidence in South Africa and our determination to grow value for all of our stakeholders,” said its CEO, Peter Steenkamp, in a note.

The go-ahead from the Department of Mineral Resources and Energy will see Harmony take over control of the mine southwest of Johannesburg, and Mine Waste Solutions, on October 1, in what would effectively be AngloGold’s exit from mining operations in South Africa.

AngloGold, which continues to operates mines in Ghana, Guinea, Australia and South America, said the decision to sell its assets “was not an easy one”. It has expressed confidence in Harmony’s ability to ensure their long-term sustainability.

“We can now sharpen our focus to pursue high return projects at several of our key assets, deliver new ounces from the world class Obuasi mine in Ghana, and advance studies in Colombia, a new frontier for our business,” said AngloGold’s Interim CEO, Christine Ramon.

The company is also in the process selling its assets in Mali, which it said would result in a “streamlined, high-margin business with quality assets and a robust pipeline for growth.”

Proceeds from the transaction will be used to reduce debt.

- READ | Harmony Gold seeks to acquire new assets amid depleting reserves

The associated assets of the South Africa transaction include the Tau Tona and Savuka mines, rock-dump and tailings storage facility reclamation sites, as well as mine rehabilitation and closure activities located in the West Wits region.

According to AngloGold, Harmony will also pay a contingent compensation of $260 per ounce on underground gold production from the Mponeng, Savuka and TauTona mines that exceeds 250 000 ounces per year for a period of six years commencing on 1 January 2021.

With one of the oldest and deepest mining sectors in the world, gold output has been in decline in South African over the last decade, making mining increasing costly.