U.S. oil costs plunged Friday after China reported its gross domestic product shrank for the very first time considering that recordkeeping began in 1992 as the economy was shut down to slow the spread of COVID-19

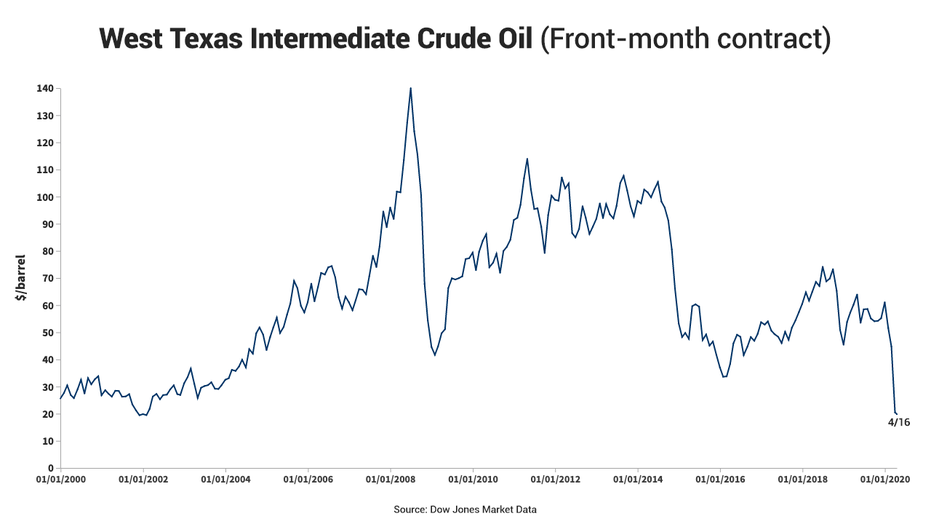

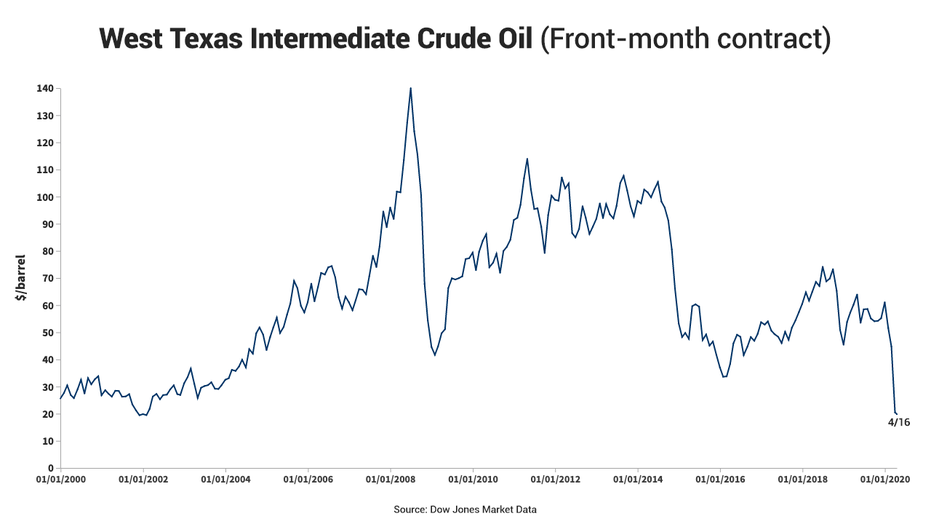

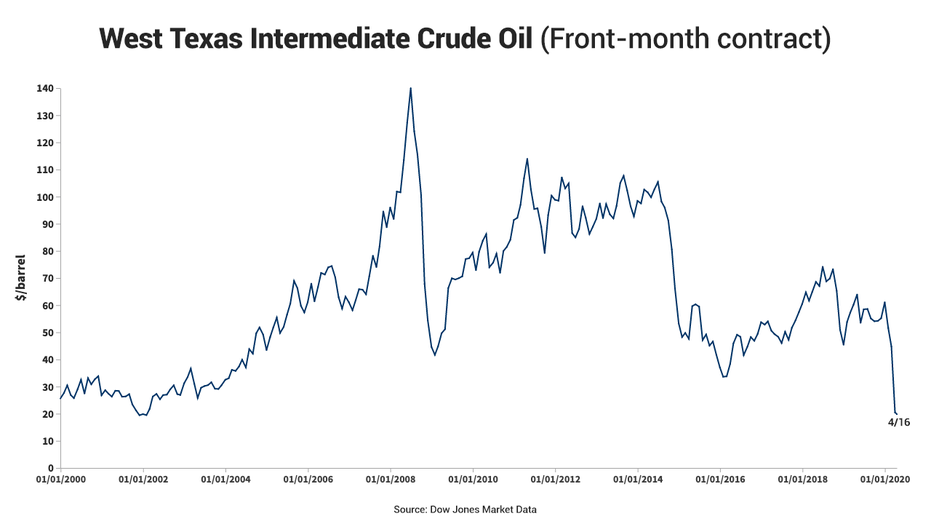

West Texas Intermediate crude oil for May shipment tumbled by as much as 9.26 percent to $1803 a barrel, its least expensive considering that October 2001, prior to trimming its losses. The agreement, which ends on Wednesday, was trading at $1859

GOLD TARGETS ‘HIGHER HIGHS’ AS CORONAVIRUS FIGHT SAPS US DOLLAR STRENGTH

” Lingering weakness in domestic demand together with an extended duration of global weakness will most likely prevent GDP from returning to its pre-virus course until a minimum of the middle of next year even in the middle of the ramp-up in policy stimulus,” composed Julian Evans-Pritchard, a Singapore-based senior China financial expert at the research company Capital Economics.

China’s first-quarter gdp fell 6.8 percent year-over-year in the January-to-March duration, according to the National Bureau of Statistics, larger than the 6 percent drop that financial experts surveyed by Reuters were anticipating.

The sharp economic contraction is a sneak peek of things to come for the rest of the industrialized world, including the United States, as the COVID-19 pandemic come from China, affecting its economy first.

CORONAVIRUS REOPENING BRINGS HIGH STAKES FOR TRUMP IN 2020 RACE

Slower financial development suggests there will be less demand for oil and its by-products, consisting of gasoline and jet fuel. In a report out Thursday, OPEC stated international need will fall by 6.9 million barrels each day in the middle of the COVID-19 pandemic. In a different report out Wednesday, the U.S. Energy Details Administration stated 9.3 million barrels each day of demand has been zapped.

The weaker need intensifies a supply excess that was made worse when a price war broke out between Saudi Arabia and Russia on March 9.

In virtual talks last weekend, the world’s biggest oil manufacturers reached a contract to trim international production by about 20 million barrels per day in May and June.

CLICK HERE TO READ MORE ON FOX BUSINESS

OPEC and its allies will decrease output by 9.7 million barrels a day while the rest of the cuts originate from major players such as the U.S. and Canada, primarily as an outcome of lower rates. The contract likewise says OPEC producers and their allies will decrease production by 7.7 million barrels a day from July through next year.