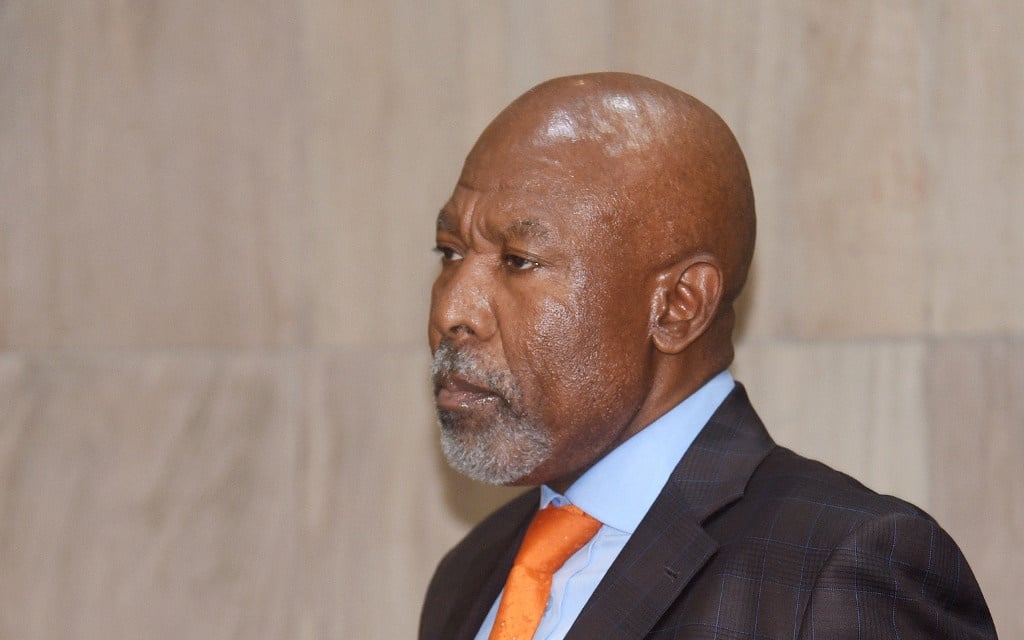

South African Reserve Bank Governor Lesetja Kganyago announces a repo rate cut at central bank’s head office on January 16, 2020 in Pretoria.

Gallo Images/Business Day/Freddy Mavunda

The Reserve Bank has introduced a 25 basis points rate cut, with Governor Lesetja Kganyago saying inflation is expected to be “well contained” in the medium term.

Kganyago on Thursday announced that the Monetary Policy Committee was divided on the decision

The repo rate – which is the benchmark interest rate at which the Reserve Bank lends money to other banks – is now at 3.5%.

The Reserve Bank has already lowered interest rates by 275 basis points this year to provide relief to indebted consumers and firms in response to the Covid-19 pandemic. But there have been calls for it to take more aggressive monetary policy action to support the economy.

The Reserve Bank has revised its GDP growth outlook to -7.3% for 2020, worse than the 7% projection in May and worse than Treasury’s forecast of 7.2%.

“Easing of the lockdown has supported growth in recent weeks and high frequency activity indicators show a pickup in spending from extremely low levels.

“However, getting back to pre-pandemic activity levels will take time. GDP is expected to grow by 3.7% in 2021 and by 2.8% in 2022,” Kganyago said.

The bank still expects inflation to average at 3.4% for 2020. “The overall risks to the inflation outlook at this time appear to be balanced,” he said.

Risks to inflation from currency depreciation are expected to be muted, he added.

But administrative prices such as electricity remain a concern for inflation.

“Upside risks to inflation could also emerge from heightened fiscal risks and sharp reductions in the supply of goods and services,” said Kganyago.